We use cookies to make your experience better. To comply with the new e-Privacy directive, we need to ask for your consent to set the cookies. Learn more.

Facing Year-End Decisions

As you approach the end of the year, business leaders like yourself have many financial decisions to consider. Some reward their employees with bonuses and holiday parties. Some invest in equipment and software to make the next year better for the team. Some give back to the community or their church. And some do all of these. What are you investing in?

Tax Considerations

When you make year-end decisions, one key factor to consider is IRS Section 179: a United States tax credit designed to help small businesses purchase equipment.

Section 179 of the IRS tax code allows you to deduct up to $25,000 of the business equipment (including tools) that you buy or lease this year from your company's 2014 gross income. To qualify for this deduction, you must place your tools into service by December 31, 2014 and use them for business purposes more than 50% of the time.

As an example: if you spend $15,000 on tools for your business this year and are in a 35% tax bracket, your tools only cost $15,000 - ($15,000 * .35) = $9,750 after tax, saving you $5,250.

To help you take advantage of this deduction, Timberwolf Tools will be open for business this entire week, plus December 22-23 and 29-31 this year. We have stocked up on our most popular tools such as the Mafell Z5Ec, ZSX Ec/400, LS 103Ec, KSS 80Ec/370, MT55cc, and P1cc. And if you need to lease a tool, Marlin Equipment Finance is ready to help you out at their toll-free number 888-479-9111 x4416.

We encourage you to read this link for more info about Section 179 and consult your tax advisor to make sure you can fully leverage this deduction, especially if your company has previously depreciated any assets.

Economic Trajectory

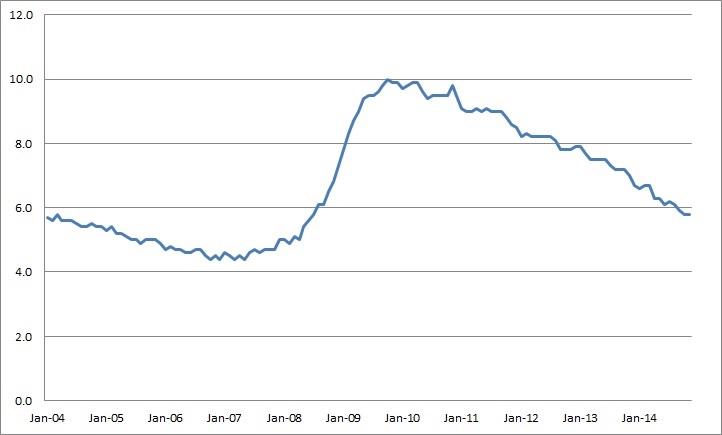

Tax benefits aren't the only reason to invest in your business right now. The United States economy has been gradually improving despite several obstacles. Even if the graph below follows the worst case scenario of 2007-2008, we still have several years until the next recession, so it's a good time to invest in major infrastructure that will last during the hard times.

U.S. Unemployment Last 10 Years

Source: U.S. Bureau of Labor Statistics

Personally, I've been seeing construction cranes back on the city skyline, the bumpy roads are getting re-paved, and there's usually a new timber frame or two viewable during my drives through the mountains. Most importantly, our customers like you sound busier when you call us because of several rewarding projects in the pipeline.

Inflation Change

One last point about end of the year decisions: it's no secret that our vendors usually raise their prices by a small percentage in the first quarter of each year, which is notable when you consider the price tags of our best products. So any tools or parts ordered the rest of this year are essentially on sale. As always, please refer to www.timberwolftools.com for our most up to date prices.

We realize that these decisions aren't easy, and really appreciate you taking the time to read our emails during this busy time of year. I hope you are looking forward to 2015 and beyond with a confident financial strategy for your business!

Jeff Powell and the Timberwolf Tools family

Toll free: 800-869-4169

www.timberwolftools.com